Why Now?

Why Now?

Corporate Jobs = Limited Upside

Working for someone else might offer stability, but it rarely leads to ownership or real wealth — you’re building someone else’s dream, not your own.

Don’t start a company with low odds and misaligned incentives

Most startups fail, and even those that succeed often leave founders diluted, stressed, and without meaningful control.

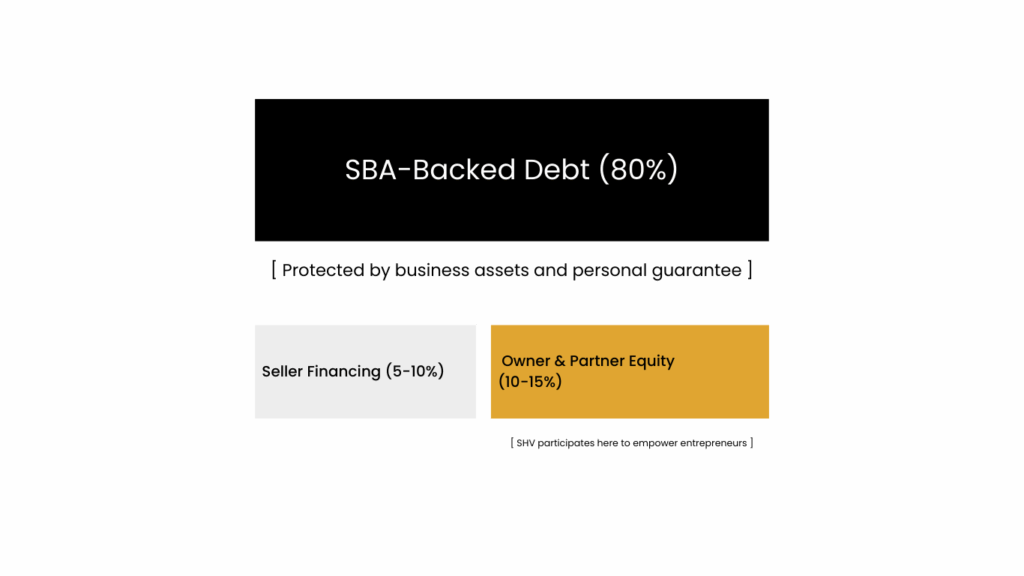

Buy a small business with SBA debt and SHV equity

Step into ownership day one, run a profitable business, and build wealth by paying down the loan.

The Acquisition Entrepreneurship Model: Buying vs. Building

Becoming a Business Owner Through Acquisition

- Self-funded search phase: Entrepreneurs identify target businesses while maintaining income sources or living on savings

- Financial structure leverages SBA financing: Government-backed loans provide up to 80% of purchase price with a personal guarantee

- Capital-efficient entry: Searchers typically need only 5-10% of business value in capital to acquire a profitable operation

Why Now? The Silver Tsunami of SMB Ownership Transfer

“Most small businesses need a buyer, not a founder.”

— Live Oak Bank

Market Forces

- 10,000+ Baby Boomers retire every day — many own profitable, cash-flowing small businesses

- 2.3M SMBs owned by Boomers will require new ownership in the coming decade

- 70%+ of business owners have no formal succession plan in place

- Over $10T in business value is projected to change hands in the next 10–15 years

National Impact

- 33M+ small businesses operate in the U.S.

- SMBs account for 44% of U.S. GDP

- They provide 49% of all U.S. jobs

-

The generational handoff is underway

— and ETA is how you participate in it